Our Story

AIIMAN Asset Management Sdn. Bhd. (“AIIMAN”) is the wholly owned Shariah investment arm of AHAM Asset Management Berhad (“AHAM Capital”). Incorporated in 2008, AIIMAN manages assets for pension funds, institutions, corporates, high net worth, and mass affluent individuals. Through an end-to-end Shariah platform, AIIMAN focuses on delivering exceptional and innovative Shariah investment solutions spanning equities and sukuk.

AHAM Capital is an independently-managed, institutionally-owned asset management firm. Since its formation in 2001, AHAM Capital has served the wealth needs of corporates, institutions, pension funds, government-linked companies, high net worth individuals and the mass affluent.

Our purpose is clear.

We are here to help our clients build wealth and achieve their financial goals through their trust.

One of the principles we held on to closely over 20 years is that this company must be built on trust. And that our client’s interests come first.

Dato’ Teng Chee Wai, Managing Director of AHAM Capital

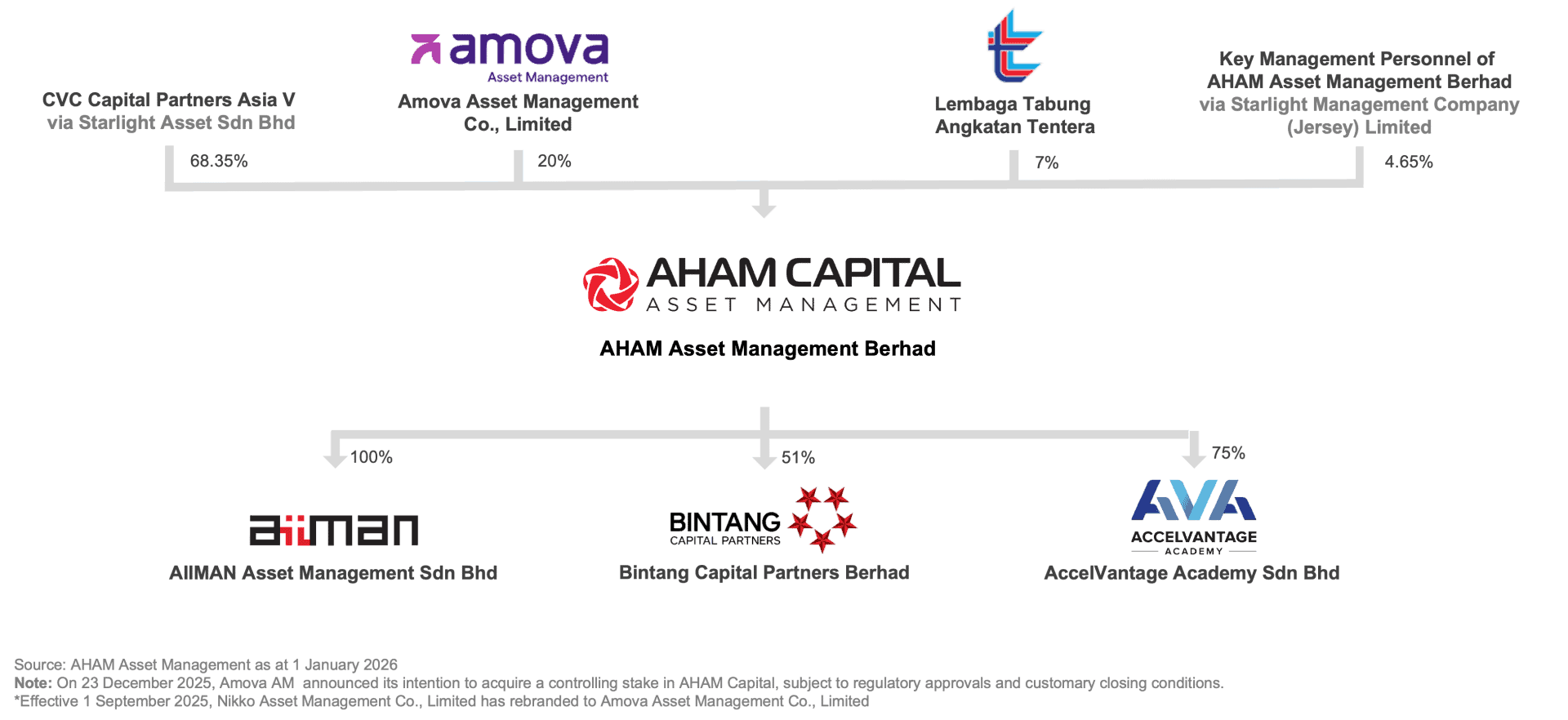

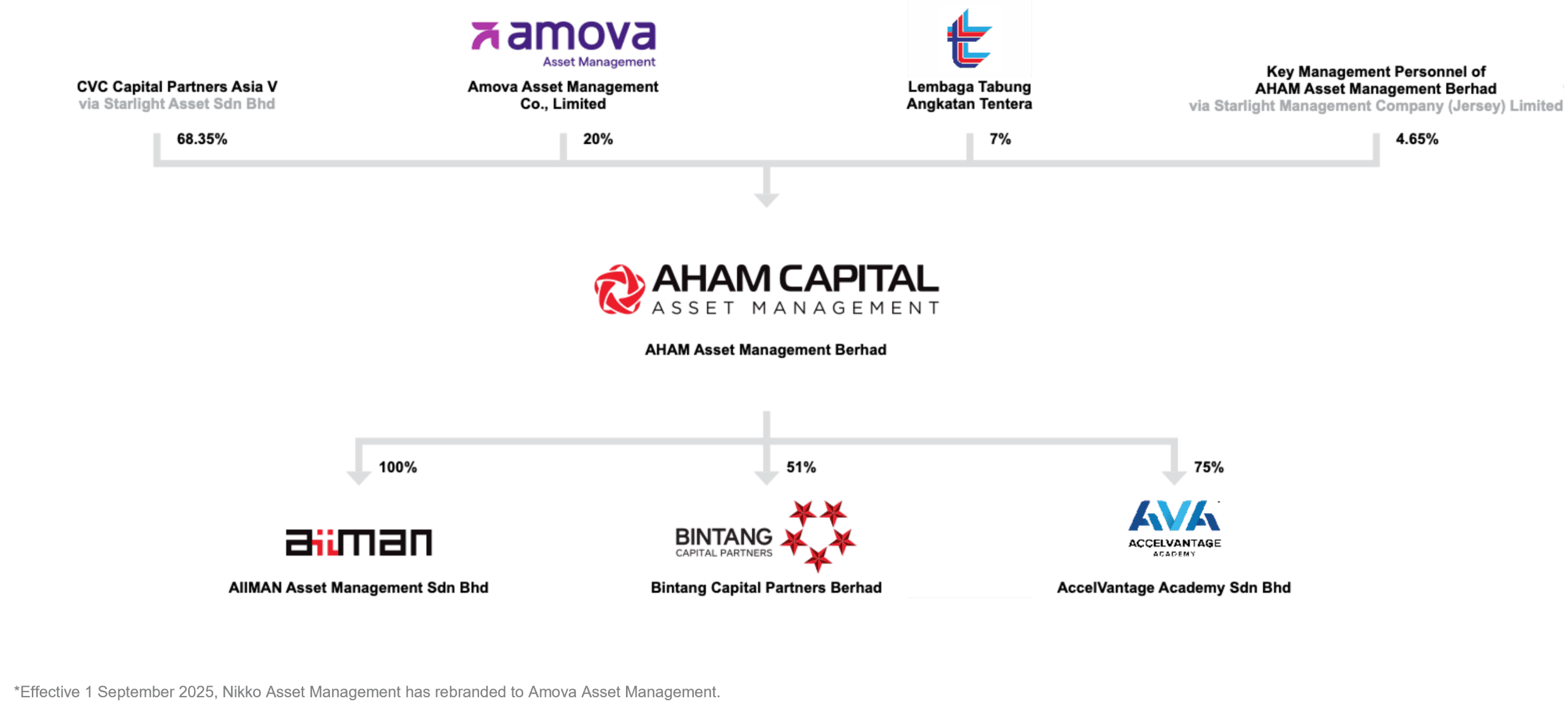

Our Shareholding Strength

We only invest in what we believe and know. As stewards of our investors’ wealth, we hold fast to the simple principle of managing their money like we would our own.

David Ng,

Deputy Managing Director & Chief Investment Officer of AHAM Capital

Our Specialisations

Unit Trust Funds

Cash Management Solutions

Portfolio Management Services

Private Retirement Scheme

Exchange Traded Fund

Our Capabilities

> RM104 billion

assets under administration

> 240

awards received for our outperformance

> 160

funds; covering local, regional and global markets

> 430

professionals across 8 offices nationwide

> 55

investment professionals

> 480

years of combined investment experience

Source : AHAM Asset Management as of 31 January 2026

Our success is centred around 3Ps. That is our

- People

- Process

- Performance

Akmal Hassan,

Managing Director of AIIMAN

Our Journey So Far

We are here for only one reason, which is to help our clients build their wealth. And only with their trust, we have been allowed to do so.

Dato’ Teng Chee Wai, Managing Director of AHAM Capital

On 29 July 2022, Affin Hwang AM was acquired by CVC Capital Partners.

On 22 November 2022, Affin Hwang AM was renamed as AHAM Asset Management (“AHAM Capital”).

2022

Affin Hwang AM partnered with fintech company, Versa to launch a digital cash management platform that allows retail investors to invest in money market funds.

AIIMAN introduces the Zakat Payment service to individual Muslim investors in March 2021.

2021

AIIMAN launched its first retail fund, Aiiman Asia Pacific (ex-Japan) Dividend Fund on 21 February 2019.

2019

The Group launched its private equity business, Bintang Capital Partners Berhad in June 2018.

AccelVantage Academy (AVA) was established as a one-stop training and support centre for financial entrepreneurs in the field of wealth management.

AIIMAN was granted the Unit Trust Management Company (UTMC) license on 27 December 2018.

2018

Affin Hwang AM and AIIMAN became signatory to the Malaysian Code for Institutional Investors on 24 March 2017.

AIIMAN registered as Institutional Unit Trust Advisers (IUTA) with FIMM on 27 November 2017.

On 6 December 2018, Affin Hwang AM rolled out its first Exchange-traded Fund, TradePlus Shariah Gold Tracker on the main market of Bursa Securities in Malaysia.

2017

Asian Islamic Investment Management was renamed as AIIMAN Asset Management (“AIIMAN”) in December 2016.

2016

On 7 April 2014, HwangDBS Investment Bank Berhad including Hwang IM and AIIMAN were acquired by Affin Holdings Berhad.

On 22 Sep 2014, Hwang IM was renamed as Affin Hwang Asset Management (Affin Hwang AM).

2014

In April 2012, the Securities Commission Malaysia approved Hwang IM as one of Malaysia’s Private Retirement Scheme (PRS) providers, making it at the time the only independent investment management company to be given such approval.

2012

Nikko Asset Management Group acquired DBS Asset Management Ltd., and consequently became a new partner and shareholder.

The company rebranded to Hwang Investment Management (Hwang IM).

2011

The Securities Commission Malaysia approved the Islamic fund management license application by Asian Islamic Investment Management (“AIIMAN”).

2008

HwangDBS IM expanded presence to the East Malaysia with its first office in Kuching, Sarawak.

2006

Rebranded to HwangDBS Investment Management (HwangDBS IM)

Launched of Institution, Corporate & HNWI Business (ICH) distribution, serving the institutional and corporate clients, as well as high net worth individuals.

2005

Hwang-DBS Unit Trust began its operations and launched its first fund, HwangDBS Select Opportunity Fund on 7 September 2001.

2001

2022

On 29 July 2022, Affin Hwang AM was acquired by CVC Capital Partners.

On 22 November 2022, Affin Hwang AM was renamed as AHAM Asset Management (“AHAM Capital”).

2021

Affin Hwang AM partnered with fintech company, Versa to launch a digital cash management platform that allows retail investors to invest in money market funds.

AIIMAN introduces the Zakat Payment service to individual Muslim investors in March 2021.

2019

AIIMAN launched its first retail fund, Aiiman Asia Pacific (ex-Japan) Dividend Fund on 21 February 2019.

2018

The Group launched its private equity business, Bintang Capital Partners Berhad in June 2018.

AccelVantage Academy (AVA) was established as a one-stop training and support centre for financial entrepreneurs in the field of wealth management.

AIIMAN was granted the Unit Trust Management Company (UTMC) license on 27 December 2018.

2017

Affin Hwang AM and AIIMAN became signatory to the Malaysian Code for Institutional Investors on 24 March 2017.

AIIMAN registered as Institutional Unit Trust Advisers (IUTA) with FIMM on 27 November 2017.

On 6 December 2018, Affin Hwang AM rolled out its first Exchange-traded Fund, TradePlus Shariah Gold Tracker on the main market of Bursa Securities in Malaysia.

2016

Asian Islamic Investment Management was renamed as AIIMAN Asset Management (“AIIMAN”) in December 2016.

2014

On 7 April 2014, HwangDBS Investment Bank Berhad including Hwang IM and AIIMAN were acquired by Affin Holdings Berhad.

On 22 Sep 2014, Hwang IM was renamed as Affin Hwang Asset Management (Affin Hwang AM).

2012

In April 2012, the Securities Commission Malaysia approved Hwang IM as one of Malaysia’s Private Retirement Scheme (PRS) providers, making it at the time the only independent investment management company to be given such approval.

2011

Nikko Asset Management Group acquired DBS Asset Management Ltd., and consequently became a new partner and shareholder.

The company rebranded to Hwang Investment Management (Hwang IM).

2008

The Securities Commission Malaysia approved the Islamic fund management license application by Asian Islamic Investment Management (“AIIMAN”).

2006

HwangDBS IM expanded presence to the East Malaysia with its first office in Kuching, Sarawak.

2005

Rebranded to HwangDBS Investment Management (HwangDBS IM)

Launched of Institution, Corporate & HNWI Business (ICH) distribution, serving the institutional and corporate clients, as well as high net worth individuals.

2001

Hwang-DBS Unit Trust began its operations and launched its first fund, HwangDBS Select Opportunity Fund on 7 September 2001.

2022

On 29 July 2022, Affin Hwang AM was acquired by CVC Capital Partners.

On 22 November 2022, Affin Hwang AM was renamed as AHAM Asset Management (“AHAM Capital”).

2021

Affin Hwang AM partnered with fintech company, Versa to launch a digital cash management platform that allows retail investors to invest in money market funds.

AIIMAN introduces the Zakat Payment service to individual Muslim investors in March 2021.

2019

AIIMAN launched its first retail fund, Aiiman Asia Pacific (ex-Japan) Dividend Fund on 21 February 2019.

2018

The Group launched its private equity business, Bintang Capital Partners Berhad in June 2018.

AccelVantage Academy (AVA) was established as a one-stop training and support centre for financial entrepreneurs in the field of wealth management.

AIIMAN was granted the Unit Trust Management Company (UTMC) license on 27 December 2018.

2017

Affin Hwang AM and AIIMAN became signatory to the Malaysian Code for Institutional Investors on 24 March 2017.

AIIMAN registered as Institutional Unit Trust Advisers (IUTA) with FIMM on 27 November 2017.

On 6 December 2018, Affin Hwang AM rolled out its first Exchange-traded Fund, TradePlus Shariah Gold Tracker on the main market of Bursa Securities in Malaysia.

2016

Asian Islamic Investment Management was renamed as AIIMAN Asset Management (“AIIMAN”) in December 2016.

2014

On 7 April 2014, HwangDBS Investment Bank Berhad including Hwang IM and AIIMAN were acquired by Affin Holdings Berhad.

On 22 Sep 2014, Hwang IM was renamed as Affin Hwang Asset Management (Affin Hwang AM).

2012

In April 2012, the Securities Commission Malaysia approved Hwang IM as one of Malaysia’s Private Retirement Scheme (PRS) providers, making it at the time the only independent investment management company to be given such approval.

2011

Nikko Asset Management Group acquired DBS Asset Management Ltd., and consequently became a new partner and shareholder.

The company rebranded to Hwang Investment Management (Hwang IM).

2008

The Securities Commission Malaysia approved the Islamic fund management license application by Asian Islamic Investment Management (“AIIMAN”).

2006

HwangDBS IM expanded presence to the East Malaysia with its first office in Kuching, Sarawak.

2005

Rebranded to HwangDBS Investment Management (HwangDBS IM)

Launched of Institution, Corporate & HNWI Business (ICH) distribution, serving the institutional and corporate clients, as well as high net worth individuals.

2001

Hwang-DBS Unit Trust began its operations and launched its first fund, HwangDBS Select Opportunity Fund on 7 September 2001.

Latest Recognitions

Note: Affin Hwang Asset Management Berhad (“Affin Hwang AM”) was rebranded as AHAM Asset Management (“AHAM Capital”) on 22 November 2022.